Struggling to figure out how much rent you can afford? Say goodbye to confusion with our Rent Calculator Hourly Wage. This handy tool takes the stress out of budgeting by helping you determine the perfect rent amount based on your hourly pay. No more guesswork or number crunching – renting just got a whole lot easier!

With our Rent Calculator Hourly Wage, you’ll breeze through the rental process with confidence. Whether you’re searching for your dream apartment or planning a budget-friendly move, our tool empowers you to make informed decisions and find the perfect place to call home. Say hello to stress-free renting with Rent Calculator Hourly Wage!

Rent Calculator Hourly Wage

Say goodbye to the guesswork and hello to clarity in your renting journey. Our Rent Calculator Hourly Wage simplifies the daunting task of determining your rent affordability. With just a few clicks, you can effortlessly calculate the ideal rent based on your hourly wage.

No more fretting over budget constraints or second-guessing your financial decisions. Our intuitive tool empowers you to make informed choices, ensuring that you find a place that suits both your lifestyle and your wallet. Renting has never been this easy – try Rent Calculator Hourly Wage today and unlock the door to stress-free renting

How It Works

Input Your Hourly Wage

Simply enter your hourly wage into the calculator.

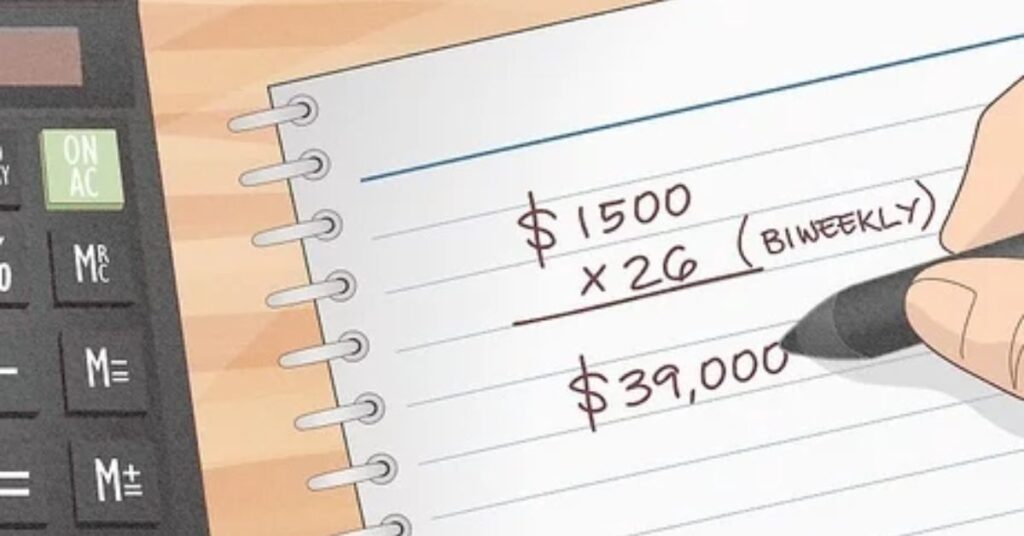

Calculate Your Monthly Income

Rent Calculator Hourly Wage automatically calculates your monthly income based on a standard 40-hour workweek.

Determine Affordable Rent

Using the recommended 30% of your income for rent, the calculator helps you identify the maximum rent you can afford.

Find Your Perfect Home

Armed with this information, you can confidently search for rental properties within your budget, making the renting process smoother and more efficient than ever before.

Your Monthly Budget Breakdown

Income Assessment: By inputting your hourly wage, the calculator computes your monthly income based on a standard 40-hour workweek.

Rent Affordability

Using the 50/30/20 rule, Rent Calculator Hourly Wage determines the recommended 30% of your income that should be allocated towards rent.

Expense Allocation

After calculating your rent affordability, the tool provides a breakdown of your remaining budget, helping you allocate funds towards other necessities, wants, savings, and debt repayment.

Decision-Making Support

With a clear understanding of your financial situation, you can confidently make informed decisions about your monthly expenses, ensuring financial stability and peace of mind.

Rent Chart Hourly Wage

Hourly Wage Input

Start by entering your hourly wage into the chart.

Monthly Income Calculation

The chart automatically calculates your monthly income based on a standard 40-hour workweek.

Rent Affordability Guidance

Using the 50/30/20 rule, Rent Chart Hourly Wage illustrates the recommended 30% of your income that should be allocated towards rent, helping you stay within budget.

Visual Representation

With a clear visual representation of your income and recommended rent expenditure, the chart enables you to quickly assess affordability and make informed rental decisions.

Factors Influencing Rent Affordability

Income Level

Higher income levels generally allow for a larger portion of income to be allocated towards rent, increasing affordability.

Location

Rent affordability varies significantly based on the location’s cost of living, with rents typically higher in urban areas and lower in rural regions.

Housing Market Conditions

Rent affordability can fluctuate based on supply and demand dynamics within the housing market, affecting rental prices.

Housing Type

The type of housing, such as apartments, condos, or single-family homes, can impact rent affordability due to differences in rental rates and amenities.

Amenities and Features

Properties with additional amenities, such as parking, laundry facilities, or access to public transportation, may command higher rents, affecting affordability.

Household Size

The number of individuals sharing the rental unit influences rent affordability, as larger households may require more space and, consequently, a higher rent budget.

Debt and Expenses

Existing debt obligations and monthly expenses, such as utilities, groceries, and transportation costs, affect how much income can be allocated towards rent.

Credit History

A positive credit history may result in lower security deposits or more favorable rental terms, enhancing rent affordability.

Market Trends

Economic conditions, inflation rates, and changes in rental market trends can impact rent affordability over time.

Size and Type of Housing

The size and type of housing significantly impact rent affordability. Generally, smaller units, such as studio apartments or one-bedroom apartments, tend to have lower rents compared to larger units, such as two-bedroom or three-bedroom apartments or single-family homes.

Additionally, the type of housing, such as apartments, condos, townhouses, or single-family homes, can also influence rent affordability.

Smaller units are often more affordable due to their reduced square footage and typically fewer amenities.

They are suitable for individuals or small households looking to minimize rental costs without compromising on essential living space. However, larger units offer more living space and amenities, but they come with higher rental prices, making them less affordable for individuals with lower income levels.

The type of housing also plays a role in rent affordability. Apartments, especially in multi-unit buildings, tend to offer more affordable rental options compared to single-family homes or townhouses.

Condos may fall somewhere in between, depending on factors such as location, amenities, and maintenance costs.

Utility Costs

Utility costs are a significant factor in determining rent affordability. These costs typically include electricity, water, gas, heating, cooling, trash removal, and sometimes internet and cable services. Understanding and budgeting for utility expenses is crucial for tenants when evaluating the overall affordability of a rental property.

Several factors influence utility costs, including:

Location

Utility rates vary by region and even by neighborhood within the same city. Urban areas may have higher utility costs due to higher demand and infrastructure expenses.

Climate

Climate conditions, such as extreme temperatures or humidity, can impact heating and cooling costs. Properties located in regions with harsh winters or hot summers may have higher utility expenses.

Energy Efficiency

The energy efficiency of the rental property’s appliances, HVAC system, insulation, and windows can affect utility costs. Energy-efficient features can lead to lower utility bills over time.

Property Size and Type

Larger properties generally have higher utility costs due to increased square footage to heat, cool, and illuminate. Additionally, single-family homes may have higher utility expenses compared to apartments or condominiums.

Tenant Behavior

Tenant behavior, such as usage patterns, thermostat settings, and water consumption habits, can influence utility costs. Energy-conscious practices can help reduce utility expenses.

Utility Billing Arrangements

The rental agreement may specify how utility costs are handled. Some landlords include utilities in the rent, while others require tenants to pay directly to utility providers.

Lease Length

Short-Term Leases

Month-to-month or short-term leases typically offer more flexibility but may come with higher monthly rental rates. Landlords may charge a premium for the convenience and flexibility of shorter lease terms, making them less affordable in the long run.

Long-Term Leases

Longer lease terms, such as one year or more, often come with lower monthly rental rates. Landlords may offer discounted rents or incentives to tenants who commit to longer lease terms, making them a more affordable option over time.

Stability and Predictability

Longer lease terms provide tenants with stability and predictability in their housing expenses. Knowing that the rent will remain consistent for the duration of the lease can help tenants budget effectively and plan for other expenses.

Renewal Options

Some leases include renewal options that allow tenants to extend their lease at the end of the initial term. Renewing a lease may come with the same rental rate or a negotiated increase, depending on market conditions and landlord policies.

Financial Considerations

When evaluating lease length, tenants should consider their financial situation, long-term housing needs, and future plans. While shorter leases offer flexibility, they may not be the most cost-effective option for tenants planning to stay in the property for an extended period.

Amenities

Amenities play a significant role in determining the overall value and rent affordability of a rental property. These additional features and services can enhance the quality of life for tenants but may also impact rental prices. Here’s how amenities influence rent affordability:

Basic Amenities

Basic amenities such as heating, air conditioning, and laundry facilities are essential for comfortable living and are typically included in the base rent. These amenities contribute to the overall value of the rental property and are considered standard offerings.

Upgraded Amenities

Some rental properties may offer upgraded amenities such as a fitness center, swimming pool, on-site parking, or outdoor recreational areas. While these amenities enhance the tenant experience, they may come with higher rental prices to cover the additional costs associated with their maintenance and operation.

In-Unit Features

In-unit amenities such as modern appliances, updated kitchens, and spacious closets can increase the desirability of a rental property and justify higher rental rates. Tenants often prioritize properties with these features for their convenience and comfort.

Utilities and Services

The inclusion of utilities (such as water, electricity, and internet) and services (such as trash removal and landscaping) in the rent can affect affordability. Properties with included utilities may command higher rents, but tenants benefit from predictable monthly expenses and simplified budgeting.

Location-Based Amenities

Amenities available in the surrounding area, such as proximity to public transportation, shopping centers, parks, and entertainment venues, can also influence rent affordability.

Properties located in desirable neighborhoods with access to amenities may have higher rental prices due to increased demand.

Pet Policies

Pet Fees and Deposits

Landlords may charge additional fees or deposits for tenants with pets to cover potential damages or cleaning costs. These fees can increase the upfront expenses associated with renting a property and affect affordability for pet owners.

Pet Rent

Some landlords may impose monthly pet rent in addition to the base rent for tenants with pets. This recurring expense can add to the overall cost of renting the property and impact affordability over time.

Breed and Size Restrictions

Landlords may enforce breed or size restrictions on pets allowed in the rental property. Certain breeds or large-sized pets may be prohibited due to insurance policies or concerns about property damage. Tenants with restricted breeds or larger pets may face limited housing options, potentially impacting rent affordability.

Pet Policies

Landlords may have specific pet policies regarding pet ownership, including requirements for pet registration, vaccination records, and adherence to leash laws. Tenants must comply with these policies to avoid potential penalties or lease violations.

Pet-Friendly Amenities

Some rental properties offer pet-friendly amenities such as designated pet areas, pet grooming stations, or nearby parks and trails. These amenities can enhance the rental experience for pet owners but may come with higher rental prices.

Negotiation

In some cases, tenants may be able to negotiate pet policies with landlords, such as reduced pet fees or exemptions from breed restrictions. Effective communication and a positive rental history can strengthen tenants’ negotiation positions.

Parking

Parking availability and policies can significantly influence rent affordability and the overall convenience of renting a property, especially in urban areas or areas with limited street parking. Here’s how parking factors into rental decisions:

On-Site Parking

Rental properties that offer on-site parking, such as designated parking spaces, garages, or parking lots, provide added convenience and security for tenants with vehicles. However, properties with on-site parking may have higher rental prices to cover the cost of maintaining parking facilities.

Off-Street Parking

Properties that offer off-street parking options, such as driveways or private parking lots, provide tenants with dedicated parking spaces away from public streets. While off-street parking can enhance the rental experience, it may come with additional fees or higher rental prices.

Street Parking

Rental properties without dedicated parking may rely on street parking, which can be limited or subject to restrictions such as permit requirements or time limits. Tenants without access to on-site or off-street parking may face challenges finding parking spaces, especially in densely populated areas.

Parking Fees

Some rental properties charge additional fees for on-site or off-street parking, which can increase the overall cost of renting the property. Tenants should consider these fees when assessing rent affordability and budgeting for housing expenses.

Public Transportation Access

Properties located near public transportation options, such as bus stops or train stations, may offer an alternative to private vehicle ownership. Tenants who rely on public transportation may prioritize proximity to transit options over parking availability.

Visitor Parking

Rental properties with visitor parking or guest parking spaces provide added convenience for tenants hosting guests or visitors. Access to visitor parking may be limited or subject to restrictions, depending on the property’s parking policies.

Safety

Safety is a critical factor in determining rent affordability and the overall desirability of a rental property. Here’s how safety considerations influence rental decisions:

Neighborhood Safety

The safety of the neighborhood where the rental property is located is a primary concern for tenants. Factors such as crime rates, vandalism, and proximity to emergency services can impact the perceived safety of the area.

Property Security

Tenants prioritize properties with adequate security measures, such as secure locks, well-lit common areas, and security cameras or patrols. Properties with enhanced security features may command higher rental prices but provide tenants with peace of mind.

Building Safety

The safety of the rental property itself, including structural integrity, fire safety measures, and compliance with building codes, is essential for tenants’ well-being. Landlords are responsible for maintaining a safe living environment for tenants.

Access Control

Properties with controlled access, such as gated communities or keycard entry systems, offer an added layer of security for tenants. These features can deter unauthorized individuals from entering the property and enhance tenant safety.

Emergency Preparedness

Tenants value properties with emergency preparedness plans and procedures in place, such as evacuation routes, fire extinguishers, and smoke detectors. Landlords should prioritize tenant safety by providing adequate emergency resources and training.

Reputation and Reviews

Tenants often rely on word-of-mouth recommendations and online reviews to assess the safety and reputation of rental properties and neighborhoods. Positive reviews and a good reputation for safety can increase tenant confidence in the property.

Personal Safety Measures

Tenants should also take personal safety precautions, such as locking doors and windows, not sharing personal information with strangers, and reporting any suspicious activity to the landlord or authorities.

Public Transport

Public transportation accessibility is a key factor in determining the convenience and affordability of a rental property, especially for tenants who rely on public transit for their daily commute or transportation needs. Here’s how public transport considerations influence rental decisions:

Proximity to Public Transit

Rental properties located near public transportation options, such as bus stops, subway stations, or train stations, offer convenience and accessibility for tenants who rely on public transit. Properties within walking distance of public transit hubs are highly desirable for tenants seeking convenient transportation options.

Cost Savings

Access to public transportation can result in significant cost savings for tenants by reducing the need for car ownership, fuel expenses, and parking fees. Tenants may prioritize rental properties with easy access to public transit to minimize transportation costs and improve overall affordability.

Commute Time and Convenience

Properties with efficient public transportation routes and connections provide tenants with shorter commute times and easier access to employment centers, schools, shopping areas, and recreational facilities. Tenants value rental properties that offer convenient transportation options to enhance their quality of life and daily convenience.

Environmental Sustainability

Choosing rental properties with access to public transportation aligns with environmentally sustainable practices by reducing carbon emissions, traffic congestion, and reliance on fossil fuels. Tenants who prioritize environmental sustainability may seek rental properties with convenient public transit options to minimize their ecological footprint.

Tenant Demographics

Properties located in urban areas or areas with a high population density often attract tenants who prefer or rely on public transportation for their daily commute. Landlords should consider the demographics of their target tenant market when assessing the importance of public transport accessibility in rental properties.

Upfront Costs

Upfront costs are an essential consideration for tenants when evaluating rent affordability and preparing for a new rental property. These costs encompass various expenses incurred before or upon signing the lease agreement and moving into the rental property. Here’s how upfront costs influence rental decisions:

Security Deposit

Landlords typically require tenants to pay a security deposit upfront, which serves as financial protection against damages to the property or lease violations. The security deposit is usually equivalent to one or two months’ rent, depending on local regulations and landlord policies.

First Month’s Rent

Tenants are generally required to pay the first month’s rent upfront before moving into the rental property. This initial rent payment is due at the lease signing and covers the first month of occupancy.

Application Fees

Some landlords may charge application fees to cover the costs of processing rental applications, conducting background checks, and verifying tenant credentials. Application fees are typically non-refundable and are paid upfront when submitting the rental application.

Pet Fees or Deposits

Tenants with pets may be required to pay additional fees or deposits upfront to cover potential damages or cleaning costs associated with pet ownership. These fees vary depending on the landlord’s pet policies and may be paid alongside the security deposit or separately.

Moving Costs

Tenants should budget for moving costs, including hiring professional movers, renting a moving truck, purchasing packing supplies, and covering travel expenses to the new rental property. These upfront moving costs can vary depending on the distance of the move and the amount of belongings being transported.

Utility Deposits

Some utility providers may require tenants to pay upfront deposits to establish new utility accounts for electricity, water, gas, or internet services. These deposits are typically refundable and serve as security against missed payments or outstanding balances.

Miscellaneous Fee

Tenants should budget for miscellaneous upfront costs, such as rental application fees, credit check fees, parking fees, or administrative fees charged by the landlord or property management company.

Frequently asked questions

What is Rent Calculator Hourly Wage?

Rent Calculator Hourly Wage is a tool that helps you determine how much rent you can afford based on your hourly wage and the 50/30/20 budgeting rule.

How does it work?

Simply input your hourly wage, and the calculator will estimate your monthly income based on a 40-hour workweek. It then calculates the recommended rent amount, ensuring it aligns with the 30% budgeting guideline.

What is the 50/30/20 rule?

The 50/30/20 rule suggests dividing your income: 50% for needs, 30% for wants, and 20% for savings and debts. Rent Calculator Hourly Wage follows this rule to determine an affordable rent amount.

How does it benefit renters?

Rent Calculator Hourly Wage provides a quick and easy way to assess rent affordability, helping renters make informed decisions and manage their finances effectively.

Is it suitable for all income levels?

Yes, Rent Calculator Hourly Wage is designed to accommodate various income levels, ensuring that individuals with different earning capacities can find suitable rental options.

Can it be used in any location?

Yes, Rent Calculator Hourly Wage can be used in any location, as it relies on your hourly wage rather than specific regional data to calculate rent affordability.

Final thought

In conclusion, Rent Calculator Hourly Wage offers a user-friendly and practical solution for individuals seeking to navigate the rental market with ease and confidence.

By providing a clear estimate of affordable rent based on hourly income and the 50/30/20 budgeting rule, this tool simplifies the process of budgeting for housing expenses. Whether you’re a first-time renter or looking to relocate, Rent Calculator Hourly Wage empowers you to make informed decisions, ensuring that your housing costs align with your financial goals and priorities.

James, with 5 years of business experience, brings expertise to our website. His profile reflects a commitment to excellence and innovation in his field.