Have you ever come across the abbreviation “GMR” on your bank statement and wondered what it means? If so, you’re not alone.

Many account holders find themselves puzzled by this cryptic code, which often appears alongside their retail purchases.

In this comprehensive guide, we’ll demystify the meaning of GMR on bank statements and provide you with valuable insights to help you better understand your financial transactions.

What is GMR on Bank Statement?

Definition of GMR

GMR stands for “General Merchandising Representation” or “General Merchandise Retailer.” It is a code used by banks and financial institutions to categorize transactions related to general merchandise purchases from retailers, often made using credit or debit cards.

Transaction Type

GMR entries typically appear on bank statements when you make purchases at general merchandise retailers, such as department stores, big-box stores, or online marketplaces that sell a wide range of products. These transactions can include in-store purchases, online orders, or even returns or exchanges at these retailers.

Common Occurrences

Some common scenarios where you might see a GMR entry on your bank statement include:

- Purchases made at department stores like Macy’s, Kohl’s, or JCPenney

- Transactions at big-box retailers like Walmart, Target, or Costco

- Online purchases from marketplaces like Amazon or eBay

Possible Sources

GMR entries can originate from various sources, including:

- In-store purchases at general merchandise retailers

- Online orders from retailers’ websites or marketplaces

- Returns or exchanges of merchandise at these retailers

Accounting Context

From an accounting perspective, GMR entries are typically categorized as general merchandise expenses or retail purchases. This categorization can be useful for budgeting, expense tracking, or tax purposes, as it helps you identify and categorize your spending on general merchandise.

Reconciliation Considerations

When reconciling your bank statement, it’s essential to cross-reference GMR entries with your actual purchases to ensure accuracy and identify any potential discrepancies or unauthorized transactions. Keeping receipts or digital records of your purchases can help facilitate this process.

Read More:

Total Health Institute Lawsuit

How to Read Your Statement

Understanding how to read your bank statement is crucial for effective financial management. Here’s a breakdown of the key sections you’ll typically find on your statement:

Cover:

The cover page of your bank statement typically includes essential information such as your account number, statement period, and contact information for your financial institution.

Deposit Summary

This section lists all deposits made into your account during the statement period, including cash deposits, electronic transfers, or direct deposits from employers or other sources.

Funding Summary

The funding summary outlines any transfers or payments made from your account to other accounts or services, such as loan payments, utility bills, or credit card payments.

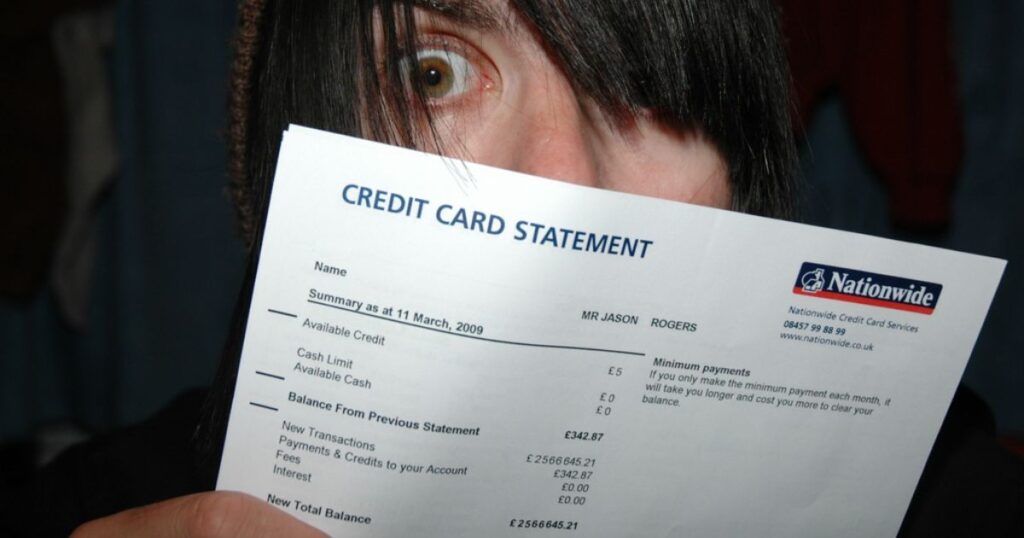

Credit Card Summary

If you have a credit card associated with your account, this section will detail your credit card transactions, including purchases, payments, interest charges, and fees.

Chargebacks & Reversals

This section may include any chargebacks or reversed transactions, which occur when a customer disputes a charge and requests a refund from the merchant.

Financial Adjustments

Financial adjustments encompass any corrections or adjustments made to your account, such as interest payments, fees, or service charges.

Charges & Fees

This section lists any fees or charges associated with your account, such as monthly maintenance fees, overdraft fees, or ATM fees.

Understanding GMR on Bank Statement

Now that you understand the definition of GMR and how to read your bank statement, let’s dive deeper into the significance of GMR entries and how to interpret them accurately.

GMR entries are crucial for tracking your spending on general merchandise, which can help you better manage your finances and budget effectively. By identifying these transactions, you can gain insights into your shopping habits and potentially identify areas where you can cut back or make more informed purchasing decisions.

Additionally, GMR entries can be helpful for tax purposes, as they can be used to substantiate deductible business expenses or provide documentation for itemized deductions related to qualifying purchases.

Common Reasons for GMR Entries

There are several common reasons why you might see a GMR entry on your bank statement:

- Retail Purchases: As mentioned earlier, GMR entries are typically associated with purchases made at general merchandise retailers, both in-store and online.

- Returns and Exchanges: If you return or exchange an item at a general merchandise retailer, the transaction may appear as a GMR entry on your statement.

- Recurring Subscriptions: Some retailers offer subscription services for recurring purchases, such as subscription boxes or memberships. These transactions may also be categorized as GMR.

- Gift Card Purchases: Purchasing gift cards from general merchandise retailers can result in a GMR entry on your statement.

- Online Marketplaces: Transactions made on online marketplaces like Amazon or eBay, which sell a wide range of products, are often classified as GMR.

Importance of GMR Entries

GMR entries play a crucial role in helping you understand and categorize your spending on general merchandise.

Here are some key reasons why these entries are important:

- Budgeting and Expense Tracking: By identifying GMR entries, you can accurately track your spending on general merchandise and adjust your budget accordingly.

- Tax Purposes: If you make deductible business purchases or qualify for itemized deductions, GMR entries can provide documentation and substantiate those expenses.

- Fraud Detection: Regularly reviewing GMR entries can help you spot unauthorized transactions or potential fraud, allowing you to take appropriate action promptly.

- Financial Transparency: GMR entries provide transparency into your spending habits, enabling you to make more informed financial decisions.

- Reconciliation: Accurately reconciling GMR entries with your actual purchases ensures the integrity of your financial records and statements.

How to Identify the Source of GMR Entries

While GMR entries can provide valuable insights into your spending, it’s essential to identify the specific source of each entry.

Here are some tips to help you track down the origin of GMR transactions:

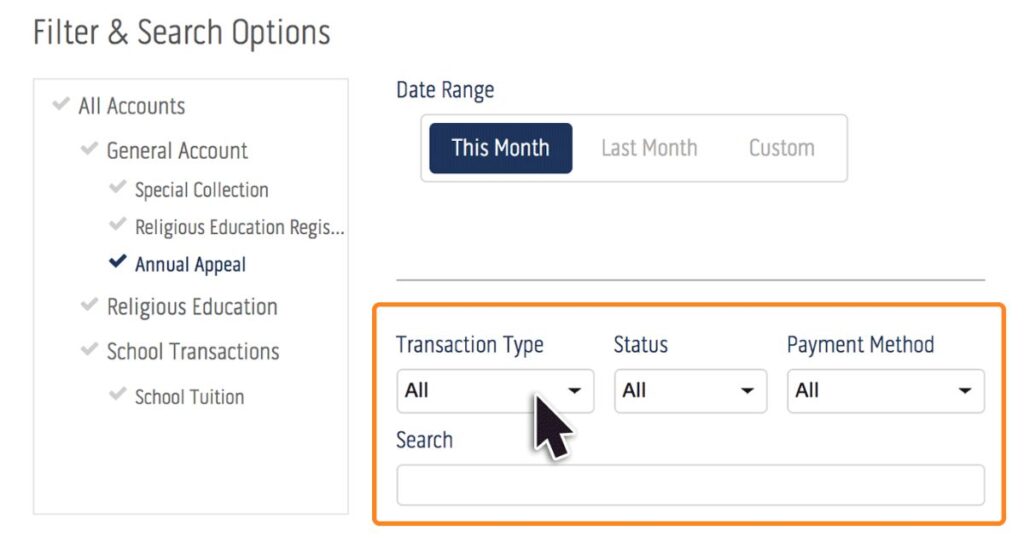

- Check Transaction Details: Most bank statements provide additional details about each transaction, such as the merchant name, location, and date. Cross-reference these details with your receipts or purchase records to identify the source.

- Review Online Statements: Many banks offer online banking platforms where you can view more detailed transaction information, including merchant descriptions and categories.

- Contact Your Bank: If you’re unable to identify the source of a GMR entry, contact your bank’s customer service for assistance. They may be able to provide more information based on the transaction details.

- Use Personal Finance Apps: Personal finance apps like Mint or YNAB can automatically categorize transactions based on merchant codes, making it easier to identify GMR entries and their sources.

- Keep Detailed Records: Maintain a system for tracking your purchases, whether it’s through receipts, digital records, or a dedicated expense tracking app. This can help you quickly identify the source of GMR entries by cross-referencing your records.

What is GMR on Bank Statement Example

| Date | Description | Amount |

|---|---|---|

| 05/01/2024 | GMR*WALMART.COM 888-966-6546 AR | $75.50 |

| 05/03/2024 | GMR*TARGET.COM 800-591-3869 MN | $42.99 |

| 05/05/2024 | GMR*MACY’S 6011 NEW YORK NY | $128.75 |

| 05/10/2024 | GMRAMAZON.COM1234567890 AMZN.COM/BILL WA | $59.99 |

What is GMR on Bank Statement Chase

GMR on a Chase bank statement typically refers to transactions made with general merchandise retailers. These transactions could include purchases from a variety of stores, such as Walmart, Target, Macy’s, or Amazon.

The GMR abbreviation is often followed by a brief description of the retailer and the location or contact details. It helps account holders identify where their money was spent when reviewing their bank statements.

What is Online Transfer to GMR?

Some bank statements may include entries labeled as “Online Transfer to GMR” or something similar. This typically occurs when you make an online purchase from a general merchandise retailer using a linked bank account or digital wallet.

In these cases, the transaction is processed as an electronic funds transfer (EFT) directly from your bank account to the retailer’s merchant account, rather than through a credit or debit card network. The “GMR” code is still used to categorize the transaction as a general merchandise purchase.

What is a GMR Account?

While the term “GMR account” is not commonly used, it could potentially refer to a merchant account specifically designated for processing general merchandise transactions.

Retailers that deal primarily in general merchandise may choose to have a separate merchant account for these types of sales, which would be categorized as a “GMR account” by the acquiring bank or payment processor.

It’s important to note that most consumers are unlikely to encounter the term “GMR account” directly on their bank statements or personal financial records.

Also Read:

Blind Frog Ranch Lawsuit 2024 Update: Unveiling The Latest Developments

Frequently Ask Question

What does GMR stand for in banking?

GMR in banking typically stands for “General Merchandise Retailer.” It’s used to categorize transactions made at various retail stores on your bank statement.

What is a GMR charge?

A GMR charge on your bank statement indicates a transaction made at a general merchandise retailer. It could represent purchases from stores like Walmart, Target, or Amazon.

What do the numbers on my bank statement mean?

The numbers on your bank statement represent various financial transactions, including deposits, withdrawals, purchases, fees, and transfers. Each entry is typically accompanied by a date, description, and amount.

How to verify external account Chase?

To verify an external account with Chase, you can use their online banking platform or mobile app. Navigate to the “External Accounts” section, where you’ll find options to add and verify external accounts securely.

How can I verify someone’s bank account?

Verifying someone’s bank account usually involves providing proof of ownership or authorization. This can be done through various methods, such as sharing bank statements, providing authorization letters, or using online verification services offered by banks.

Final Thoughts

Understanding the meaning of GMR on bank statements is an essential aspect of financial literacy. By decoding this abbreviation and its implications, you can gain valuable insights into your spending habits, better manage your budget, and ensure the accuracy of your financial records.

Remember, GMR entries are commonly associated with purchases made at general merchandise retailers, both in-store and online. By carefully reviewing these transactions and cross-referencing them with your receipts or purchase records, you can stay on top of your finances and make informed decisions about your spending.