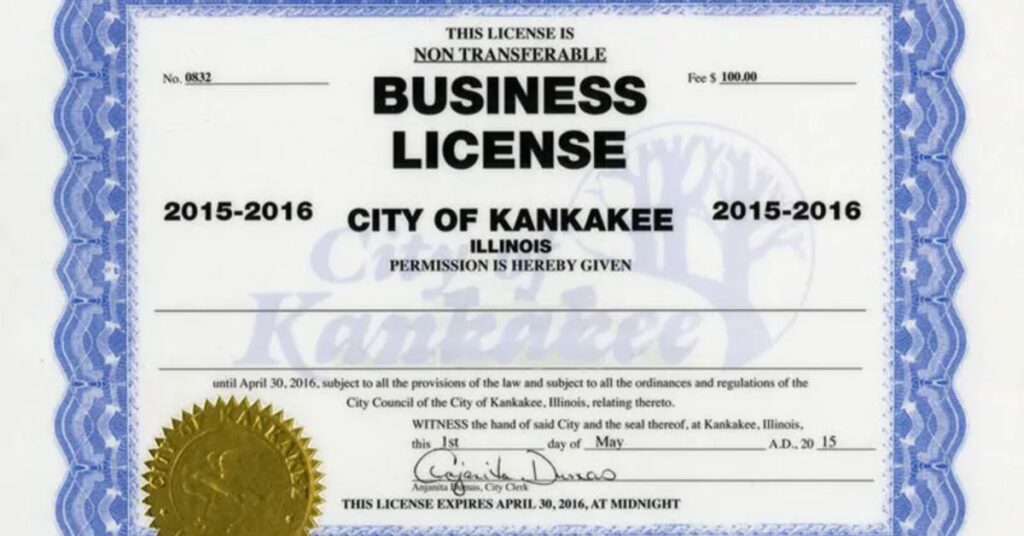

Starting a business in California can be an exciting venture, but it also comes with its fair share of administrative tasks and financial considerations. One such consideration is obtaining a business license, a crucial step in ensuring legal compliance and legitimacy for your enterprise.

However, many entrepreneurs find themselves asking, “How much is a business license in California?” In this comprehensive guide, we delve into the intricacies of business licensing in the Golden State, exploring the various costs involved, factors influencing those costs, and essential steps to obtaining a license.

Understanding Business Licensing in California

Before delving into the cost aspect, it’s essential to grasp the basics of business licensing in California. A business license is essentially a permit issued by a government authority that allows individuals or companies to conduct business within a specific jurisdiction.

In California, the process of obtaining a business license is typically managed at the local level, meaning that the requirements and fees may vary depending on your location within the state.

Read As: Flutterwave Scandal Shakes the Fintech World

Types of Business Licenses

Business licenses in California can vary based on factors such as the type of business, its location, and its structure. Some common types of business licenses in California include:

General Business License: Required for most businesses operating within a city or county jurisdiction.

Professional License: Necessary for businesses that provide services requiring professional qualifications, such as doctors, lawyers, and accountants.

Home-Based Business License: Required if you plan to operate your business from your residence.

Special Permits or Endorsements: Additional permits may be necessary for certain activities, such as selling alcohol or operating a food establishment.

Each type of license may incur different costs, so it’s crucial to identify the specific license(s) your business needs.

Factors Influencing Business License Costs

The cost of obtaining a business license in California can vary significantly based on several factors. Understanding these factors can help you estimate the expenses involved more accurately:

1. Location

As mentioned earlier, business licensing is managed at the local level in California. Therefore, the city or county where your business is located will heavily influence the cost of your business license. Larger cities or counties may have higher license fees compared to smaller, rural areas.

2. Type of Business

The nature of your business also plays a significant role in determining license costs. Certain industries or business activities may require additional permits or endorsements, which can incur extra fees. For example, businesses in highly regulated sectors like healthcare or construction may face higher licensing costs due to stringent requirements.

3. Business Structure

The legal structure of your business can impact licensing costs as well. Sole proprietorships, partnerships, corporations, and limited liability companies (LLCs) may have different fee structures or requirements for obtaining a business license.

4. Annual Renewal Fees

In addition to the initial license fee, many business licenses in California require annual renewal. These renewal fees can add to the overall cost of maintaining your business license over time.

5. Penalties and Late Fees

Failure to obtain or renew a business license on time can result in penalties and late fees, further increasing the overall cost. It’s essential to stay informed about renewal deadlines and comply with all requirements to avoid these additional expenses.

Cost of Business Licenses in California

Now that we’ve outlined the key factors influencing business license costs let’s explore some specific examples to give you a clearer idea of what to expect:

Example 1: City of Los Angeles

The City of Los Angeles offers a comprehensive guide to business licensing on its official website. As of [insert date], the cost of a new business tax registration certificate (BTRC) in Los Angeles ranges from $0 to $198, depending on the estimated gross receipts of the business. Additionally, certain business activities may require a regulatory permit, which can range from $0 to $7,500.

Example 2: City of San Francisco

In San Francisco, the cost of a business registration certificate varies based on factors such as the type of business, number of employees, and gross receipts. As of [insert date], the minimum annual license fee for most businesses is $91.08, with additional fees for businesses with higher gross receipts or specific activities.

Example 3: City of San Diego

In San Diego, the cost of a business tax certificate is determined by the gross annual business income. As of [insert date], the fee ranges from $34 to $1,000, with additional fees for certain business activities or regulatory permits.

Steps to Obtaining a Business License in California

Now that you have a better understanding of the costs involved let’s outline the general steps to obtaining a business license in California:

Research Requirements: Determine the specific license(s) your business needs based on its location, type, and activities.

Complete Necessary Forms: Fill out the required application forms for your business license(s) and any additional permits or endorsements.

Submit Application: Submit your completed application forms along with any required documentation and fees to the appropriate local government office.

Wait for Processing: Allow time for your application to be processed. Processing times may vary depending on the complexity of your application and local government procedures.

Receive License: Once your application is approved, you will receive your business license(s) and any accompanying permits or endorsements.

Renew Annually: Remember to renew your business license(s) annually to maintain legal compliance and avoid penalties.

Read As: how long to get a business degree

Conclusion

In conclusion, the cost of obtaining a business license in California can vary depending on factors such as location, type of business, and annual income. By understanding these factors and following the necessary steps, you can navigate the process of obtaining a business license more effectively.

Remember to research your specific requirements, budget for initial and ongoing fees, and stay informed about renewal deadlines to ensure the smooth operation of your business. Ultimately, investing in proper licensing is essential for legal compliance, credibility, and the long-term success of your enterprise.

James, with 5 years of business experience, brings expertise to our website. His profile reflects a commitment to excellence and innovation in his field.